One of the more ill thought out plans announced in last week’s Spending Review already in the firing line…

This article titled “Housing benefit cap plan will backfire, ministers told” was written by Randeep Ramesh, Allegra Stratton, Hélène Mulholland and Amelia Gentleman, for The Guardian on Thursday 28th October 2010 20.24 UTC

This article titled “Housing benefit cap plan will backfire, ministers told” was written by Randeep Ramesh, Allegra Stratton, Hélène Mulholland and Amelia Gentleman, for The Guardian on Thursday 28th October 2010 20.24 UTC

Government housing reforms were under attack on multiple fronts as council home associations predicted they would backfire by driving up overall welfare bills and Boris Johnson warned against “Kosovo-style social cleansing” of poorer people from cities such as London.

Downing Street moved to squash growing ministerial dissent by signalling there would be no retreat from the biggest shake-up to social housing since the welfare state was created, with a series of radical changes to rents and savage cuts to the budget for building new homes.

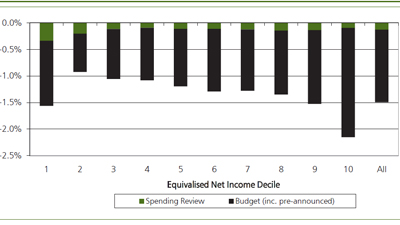

Last week George Osborne, the chancellor, announced that the housing budget for England would be cut from £8.4bn over the previous three-year period to £4.4bn over the next four years with any new properties being built by “massively increasing” rent to up to 80% of the market rate.

But the National Housing Federation, which represents housing associations, says the scheme would increase welfare bills as most tenants charged the new rates would have their rents paid for through housing benefit.

The federation says that in areas where rents are already high, such as the London boroughs of Camden, Hackney and Haringey, many tenants moving into new social homes would face bills of £340 per week for a three-bedroom property. Even if people could get a job, their earnings would disappear in high rent repayments.

This would mean they “would have to earn at least £54,000 before they could get off housing benefit and be in a position where they could keep the bulk of their additional salary and find themselves better off in work”.

The changes, including the removal of lifetime tenure for council tenants, are designed to ease the pressures on social housing, with 1.8m households on the waiting list for a subsidised home – almost double the number since the Tories were last in government in 1997.

David Orr, chief executive of the National Housing Federation, said: “Because it is based on near-market rents, the new funding model will trap thousands of tenants in welfare dependency because they will simply not be able to earn enough money to pay for their homes without the support of housing benefit – which means the benefit bill for new low-cost housing will go through the roof.”

He warned “the government’s strategy will turn the traditional understanding of what constitutes social housing on its head by creating a system based around high rents and short-term tenancies. Ministers need urgently to rethink their plans and give housing associations the flexibility to respond to the growing housing crisis in the most effective manner possible.”

The coalition has been under pressure for days over accompanying changes to housing benefit, designed to cut £2.5bn from public spending. The changes include a 10% drop in housing benefits for those out of work for more than a year and new caps of up to £400 a week for the largest homes.

Tonight the housing minister, Grant Shapps, insisted the government was not insensitive to concerns being put forward by housing groups. “I think that every family who has to move for whatever reason, that is somebody’s life being deeply affected, I absolutely recognise that,” he said an interview with the Guardian.

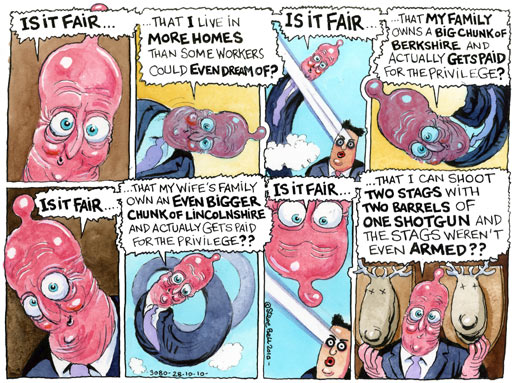

“Just because you are on housing benefit, that shouldn’t give you the ability to live somewhere, where if you are working and not on benefit you can’t. We’d all love to live in different areas, but I can’t afford to live on x street in y location. The housing benefit system has almost created an expectation that you could almost live anywhere, and that’s what has to stop.”

Downing Street has moved swiftly to smother dissent over how the welfare bill is being slashed as the government tries to narrow its record budget deficit.

Johnson, the Conservative London mayor, had expressed concern about the possible effects of government plans to reduce social-housing subsidies, a step that may force people on low incomes to move to areas where rents are cheaper.

“The last thing we want to have in our city is a situation such as Paris where the less well-off are pushed out to the suburbs,” Johnson told BBC London. “What we will not see and we will not accept is any kind of Kosovo-style social cleansing of London.”

The business secretary, Vince Cable, said Johnson’s language was “ludicrously inflammatory”, while the prime minister’s spokesman said: “The prime minister doesn’t agree with what Boris Johnson has said or indeed the way he said it. He thinks the policy is the right one and he doesn’t agree with the way [he] chose his words.” Johnson later insisted he had been quoted “out of context”.

His views were echoed in less lurid language by the children’s minister, Tim Loughton, who stressed he was not criticising the reforms, but said they were “very real concerns about poorer families being forced out of central London into the outer boroughs and I think that’s a very legitimate concern”.

guardian.co.uk © Guardian News & Media Limited 2010

Published via the Guardian News Feed plugin for WordPress.